In reality, life happens, emergencies happen, and investors panic and sell in bad times. It always rebalances every year and withdraws the right amount.

Another way to say this is: high returns are relatively large but infrequent, while lower returns are more common. The bar chart showing the distribution of ending balances is weighted to the left in most setups.

#Investment drawdown calculator simulator

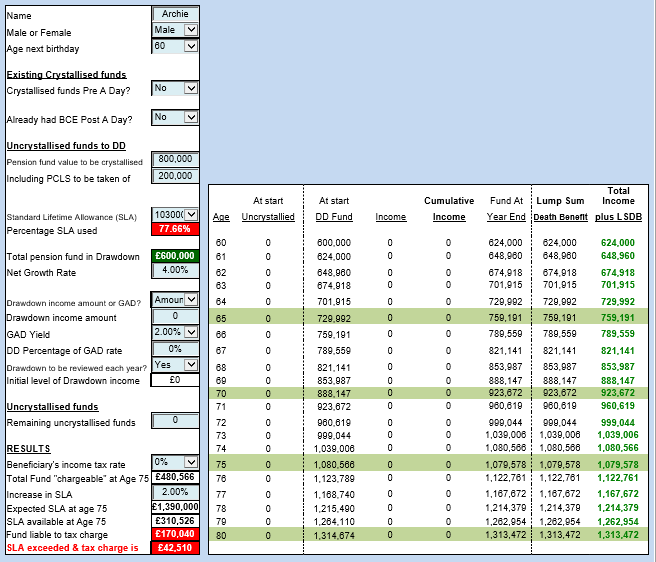

The simulator uses the returns of 90 Day US Treasury Bills. Cash - percent of funds to put into a 'risk free' investment.Bonds - percent of funds to put into 10 Year US Treasury Bonds, with returns including coupon and price appreciation.Stocks - percent of funds to put into the US S&P 500 Index.Portfolio Strategy - you can pick from the predefined allocations of Stocks, Bonds, and Cash, or enter your own.This aims to answer the classic question " Will I die rich or die broke?" . The calculator displays the percentage of simulations that exceeded the goal.

Goal - how much you would like to have in the end.Withdraw Percent - the percent of your nest egg you plan to withdraw in the first year to live on, see Withdraw Amount notes.During the simulations the withdraw amount is adjusted for inflation. Withdraw Amount - how much you plan to withdraw in the first year (this amount does not count social security, pensions, or other income sources, just the amount you plan to take out of your nest egg each year).Savings at Retirement - how much money you have saved up before retiring and starting to draw on your nest egg.Length of Retirement - how long do you expect to live after you retire? Age 100? Age 85? To be conservative, enter a higher value.It outputs the percent of time the simulated nest egg stayed above water or ran out of money. It is useful for comparing portfolio allocation outcomes, realistic withdraw rates, and setting a savings goal.

This calculator generates simulation runs for each year of data in our historical dataset (1928 - present) based on what you enter above. Related to this calculator, check out our Saving for Retirement Calculator and Portfolio Allocation Calculator.

0 kommentar(er)

0 kommentar(er)